Markets React to War, NATO’s $ Trillions, and Trump’s $4.2T Bill

Weekly Digest Outlook: Middle East conflict sends oil swinging… NATO raises defense target to 5% GDP… Trump’s “Big Beautiful Bill” nears passage despite Musk’s attack.

Weekly Digest Outlook: Geopolitical Storms Shape Market Direction

Key Takeaways: The past two weeks delivered three major developments reshaping investment landscapes: the 12-day Israel-Iran conflict that sent oil prices swinging, NATO's historic 5% defense spending commitment, and the contentious passage of Trump's "One Big Beautiful Bill." Meanwhile, Elon Musk's public opposition to the legislation highlights growing tensions between tech leaders and fiscal policy.

What Investors Should Know

Middle East Crisis Creates Energy Volatility

The June 13-24 Israel-Iran conflict demonstrated how quickly geopolitical tensions translate into market movements. Oil prices surged from $70 to $81 per barrel during peak hostilities before dropping to $68 following the ceasefire announcement. This 16% price swing within twelve days underscores the energy sector's sensitivity to Middle East developments.

The conflict's scope was unprecedented in recent years. Iran launched hundreds of ballistic missiles targeting Israeli cities and military installations, while Israel conducted extensive airstrikes against Iranian nuclear facilities and military infrastructure. U.S. involvement escalated on June 21 when American forces struck three Iranian nuclear sites, marking the first direct U.S. attack on Iranian soil.

For investors, the rapid oil price normalization following the ceasefire suggests markets view this as a contained regional conflict rather than a prolonged energy crisis. However, the volatility patterns reveal how quickly commodity prices can shift when major supply routes face potential disruption.

NATO Summit Reshapes Defense Investment Landscape

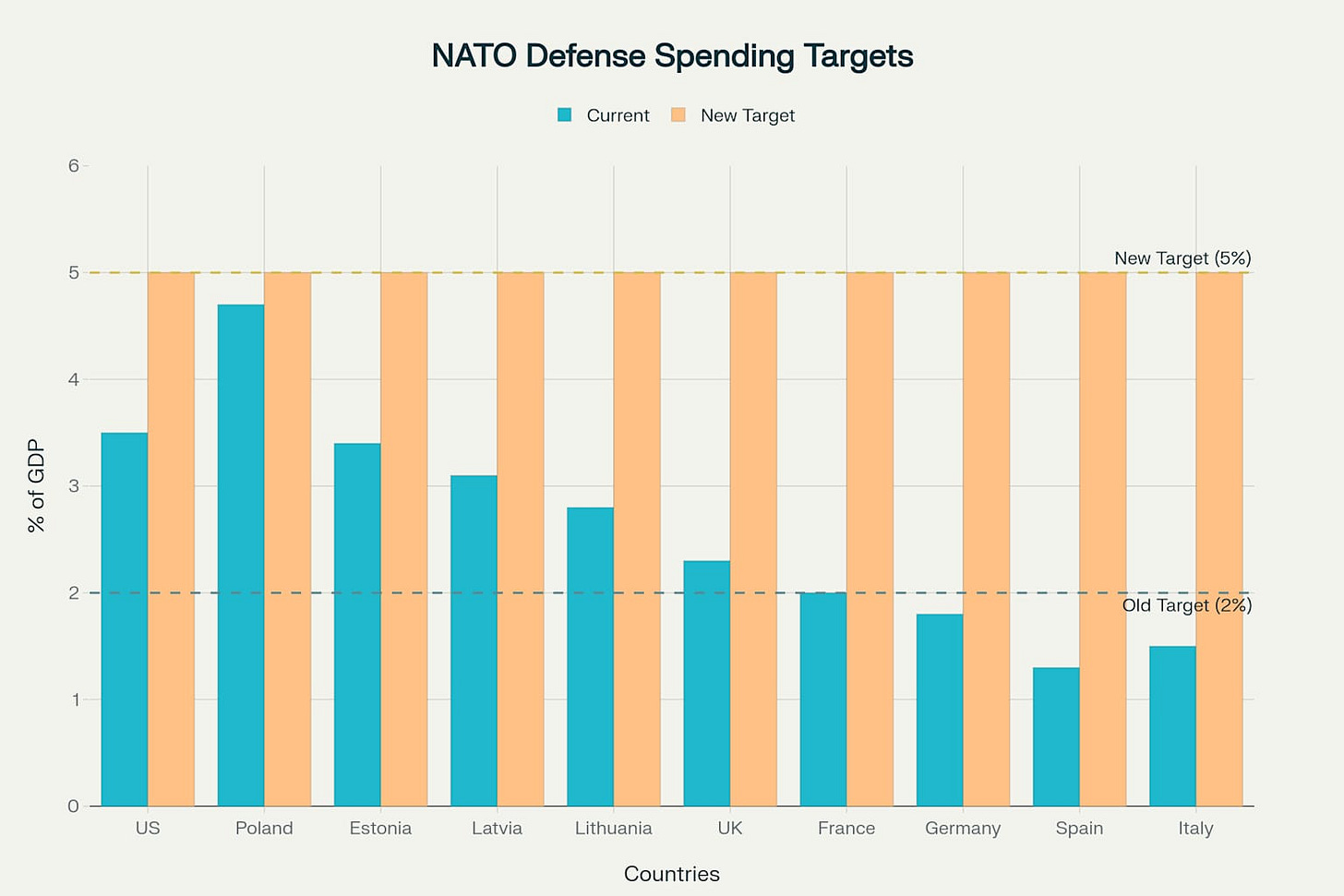

The Hague NATO Summit delivered a landmark agreement raising defense spending targets from 2% to 5% of GDP by 2035. This represents the most significant military spending commitment in NATO's 75-year history, with profound implications for defense contractors and related industries.

The new structure allocates 3.5% of GDP to core defense spending and 1.5% to defense-related infrastructure, including cybersecurity, transportation networks, and industrial capacity. European defense stocks have already responded positively, with companies like Rheinmetall surging 177% year-to-date as Germany committed to reaching 3.5% by 2029.

President Trump's pressure for increased allied contributions appears successful, though implementation challenges remain. Countries like Spain initially sought exemptions, while fiscal constraints may limit Southern and Western European nations' ability to meet targets rapidly.

Trump's Big Beautiful Bill Advances Despite Opposition

Congress is racing toward Trump's July 4 deadline for the $4.2 trillion "One Big Beautiful Bill Act". The legislation combines tax cuts, border security funding, and significant reductions to social programs, particularly Medicaid.

The Congressional Budget Office estimates the bill would add $3.3 trillion to deficits over ten years while potentially leaving 11.8 million Americans without health insurance by 2034. These projections highlight the legislation's massive fiscal and social implications.

Republican unity faces strain as Senator Thom Tillis announced his retirement after opposing the bill's Medicaid cuts. With a narrow 53-47 Senate majority, Republican leaders can afford only three defections.

Musk's Opposition Signals Tech-Political Divide

Elon Musk's vocal criticism of Trump's legislation reveals growing tensions between tech leadership and fiscal policy. Musk specifically targeted provisions eliminating clean energy incentives, arguing they would "destroy millions of jobs" and damage America's competitive position in renewable energy.

The billionaire's concerns center on the bill's impact on Tesla's energy division and broader clean technology sectors. His criticism of wind and solar tax credit eliminations reflects how policy changes directly affect tech companies with diversified energy portfolios.

Expert Comments

Financial analysts emphasize the interconnected nature of these developments. Lazard's research suggests prolonged Middle East instability could discourage foreign investment in Gulf regions while maintaining oil price volatility. However, the swift ceasefire implementation suggests regional powers prefer de-escalation.

Defense sector analysts at Bank of America highlight front-loaded opportunities in countries like Germany, where increased spending timelines favor immediate procurement. The NATO agreement creates a multi-year growth trajectory for defense contractors, particularly those with established European operations.

Congressional Budget Office analysis reveals the fiscal legislation's long-term implications extend far beyond immediate tax relief. Interest payments on national debt could reach record levels, potentially constraining future policy flexibility.

What to Expect Next

Energy Markets: Watch for continued oil price sensitivity to Middle East developments. The ceasefire holds for now, but underlying tensions remain elevated. Any disruption to the Strait of Hormuz could trigger dramatic price increases.

Defense Spending: European defense procurement will accelerate through 2029, creating sustained revenue growth for major contractors. However, fiscal constraints may delay some commitments, particularly in Southern.

Fiscal Policy: The Big Beautiful Bill's passage appears likely before July 4, but implementation challenges will emerge throughout 2025. Medicaid changes and clean energy cuts will face legal challenges and state-level resistance.

Tech-Government Relations: Musk's opposition signals broader tech sector concerns about renewable energy policy reversals. This tension may influence future climate technology investments and government contract relationships.

The convergence of geopolitical tensions, defense commitments, and domestic fiscal policy creates a complex investment environment requiring careful sector allocation and risk management. While short-term volatility is likely, the underlying trends toward increased defense spending and energy security investments offer long-term positioning opportunities for astute investors.